Information from: Shenzhen Government Online

Application Requirements

When an in-charge tax authority launches a General Anti-Avoidance Rules (GAAR) investigation, the enterprise being investigated should provide the relevant documentation within 60 days upon receiving a Tax Investigation Notice if it does not consider its arrangement as a tax avoidance arrangement as prescribed in the Administrative Measures of General Anti-Avoidance Rules. An application for an extension of provision of materials for a GAAR investigation refers to the case where the enterprise is unable to provide the required information within the prescribed time frame due to exceptional circumstances, in which case it can apply in writing to the in-charge tax authority for an extension. An extension of no more than 30 days will be granted upon approval. If the in-charge tax authority gives no written reply within 15 days upon receiving the application for an extension, it will be deemed to have given consent to the extension.

Legal Basis

Article 11 of the Administrative Measures of General Anti-Avoidance Rules (Trial Implementation) (State Taxation Administration Decree No.32)

Materials Needed: Application for an extension of provision of materials for general anti-avoidance investigation

Notes:

1. Taxpayers are responsible for the authenticity and legality of the materials submitted.

2. Taxpayers are required to submit paper documents when they go to the tax service hall to handle their tax affairs,or submit electronic documents according to the operation requirements of the online system if they handle their tax affairs online or through mobile terminals.

3. For materials not specified as original or printed copies in the “Materials Needed” list, the original copies shall be provided; for materials specified as printed copies, only printed copies shall be provided; for materials specified as original and printed copies, the printed copies will be collected and the original copies will be returned after verification.

4. The submitted printed copies must state its consistency with the original copies and be stamped with the company’s official seal.

Service Channels

1. The department in charge of special tax adjustments of the competent tax authority

“City-wide Universal Processing” servicescurrently are not available at any of the tax service halls.

2. Self-service tax terminal access is currently not available.

3. Online service

No online services are currently available.

Processing Authority

The department in charge of special tax adjustments of the competent tax authority

Processing Time

1. Time limit for taxpayers

Within 60 days upon receiving a Tax Investigation Notice

2. Time limit for tax authorities

Within 15 days upon receiving the application foran extension of provision of materials for a general anti-avoidance investigation from the enterprise being investigated

Tel.

Please refer to the tax service map for contact numbers of each tax service hall.

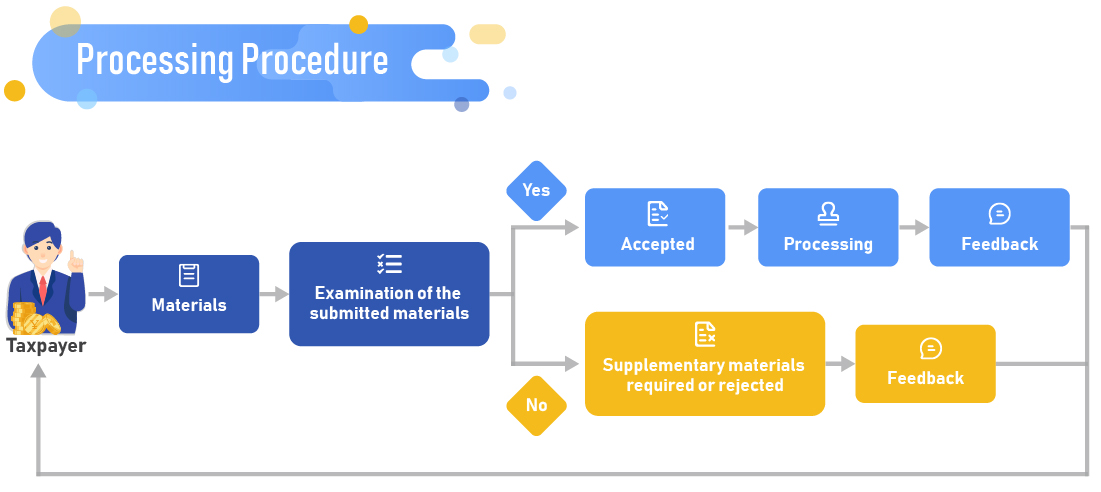

Processing Procedure

Processing Result

Tax authorities will give feedback in writing on the processing result.

Notices for Taxpayers

1. Taxpayers need to visit the tax authorities only once at most on the precondition that the materials are complete and meet the legal requirements for acceptance.

2. If taxpayers fail to file tax returns and submit required tax materials in accordance with the prescribed period, their result of tax credit evaluation will be affected.

3. An extension of provision of materials for general anti-avoidance investigation of no more than 30 days may be granted to the enterprise upon approval from the tax authority in charge.

4. The address of tax service halls and the official website of e-tax bureau can be found on the web portal of tax authorities or by calling the tax service hotline 12366.

Fees

Free of charge

Application Forms

N/A.

Instructions for Filling out Forms

N/A.