1 Policy Content

Overseas high-end and talents in short supply working in Shenzhen receives subsidies based on the difference between the individual income tax (IIT) of the Mainland and that Hong Kong, and such subsidies will be exempted from IIT.

2 Policy Reference

3 Applicable targets

3.1 An applicant shall meet one of the following identity conditions:

3.1.1 a permanent resident of Hong Kong or Macao, holding the permanent identity certificate of a Hong Kong or Macao resident or the Mainland Travel Permit for Hong Kong and Macao Residents.

3.1.2 a mainland resident residing in Hong Kong or Macao (with his or her mainland registered residence cancelled), holding the identity certificate of a Hong Kong or Macao resident or the Mainland Travel Permit for Hong Kong and Macao Residents.

3.1.3 a Hong Kong resident under the Hong Kong Quality Migrant Admission Scheme (for outstanding talents, professionals, or entrepreneurs), excluding dependents, and holding the identity certificate of a Hong Kong resident, the identity certificate of a mainland resident, and a relevant visa issued by the Hong Kong Immigration Department.

3.1.4 a resident of the region of Taiwan, holding the Mainland Travel Permit for Taiwan Residents.

3.1.5 a foreign national, holding a foreign passport or the permanent residence permit for foreigners.

3.1.6 a returned overseas student who has obtained the right of long-term residence abroad, holding a Chinese passport, the identity certificate of a mainland resident, a long-term or permanent foreign resident certificate, and a foreign certificate of academic degree issued by the Chinese Service Center for Scholarly Exchange of the Ministry of Education. If necessary, a notarized certificate or certificate of recognition for the long-term or permanent right of residence issued by the Chinese embassy or consulate in the residing country or a notarized certificate and residence record issued by the embassy and consulate of the residing country in China shall be provided as supplementary documents.

3.1.7 an overseas Chinese, holding a Chinese passport, the identity certificate of a mainland resident, a foreign residence certificate, and entry and exit records. If necessary, a notarized certificate or certificate of recognition for the right of residence issued by the Chinese embassy or consulate in the residing country or a notarized certificate and residence record issued by the embassy or consulate of the residing country in China shall be provided as supplementary documents.

This application is open for Overseas High-end Talents and Talents in Short Supply in Shenzhen city. Overseas High-end Talents are recognized and qualified by government.The Talents in Short Supply in Shenzhen city are independently accredited by the applying entity, and the written description and commitment provided by the applying entity shall prevail.

3.2 Overseas High-end Talents are eligible for application:

3.2.1 Those who are selected to a national, provincial or municipal major talent project;

3.2.2 Overseas high-level talents accredited at national, provincial or municipal level;

3.2.3 Talents who hold the Superior Talent Card of Guangdong Province.

3.2.4 Talents who hold a foreigner's work permit (Class A or B) or a confirmation letter for high-end foreign talents.

Conditions in the above Sub-items 1 to 3 must be proven through certificates or relevant recognition documents issued by the national, provincial, and municipal government departments, and the validity period of the relevant certificates is not a restriction on the application (except for those that have been revoked)

3.3 Talents in Short Supply in Shenzhen city are eligible for application:

3.3.1 Scientific research team members and middle-level & higher-level managers of major national, provincial, or municipal innovation platforms.

3.3.2 Members of scientific research and technical teams, middle-level & higher-level managers, or team members undertaking major vertical research projects at or above the municipal level in institutions of higher education, scientific research institutions, hospitals, or public health institutions; leaders of key disciplines and key specialties at or above the municipal level; and core talents of medical and health technologies.

3.3.3 Middle-level & higher-level managers, scientific research team members, core technicians and workers and outstanding young talents of headquarters enterprises, Fortune 500 enterprises and their branches, high-tech enterprises, large key enterprises, listed enterprises and technologically advanced enterprises.

3.3.4 Middle-level & higher-level managers, scientific research team members, core technicians and workers and outstanding young talents who are employed or start a business in key development industries and key fields in Shenzhen.

3.4 Working conditions of applicants:

3.4.1 The applicant works in Shenzhen and meets one of the following conditions:

(1) Having signed a labor (employment) contract with an employer in Shenzhen;

(2) Being dispatched by an overseas employer who has signed a dispatch contract with the receiving entity in Shenzhen; or

(3) Providing independent personal labor services and having signed labor contract with a taxpayer in Shenzhen.

3.4.2 The applicant has worked in Shenzhen for a total of 90 days in the current year.

3.4.3 If the applicant no longer works for an entity eligible for the application after working for the entity for 90 days, the applicant can declare through the entity and the entity should cooperate.

3.5 Other requirements for applicants

3.5.1 The applicant does not enjoy one of the following awards or subsidies under the preferential policies for talents in 2021:

(1) Shenzhen Industrial Development and Innovation Talent Award.

(2) Special funds for talent development guidance of Qianhai Shenzhen-Hong Kong Modern Service Industry Cooperation Zone of Shenzhen.

3.5.2 The applicant must complete the annual final settlement and payment before the application. If the applicant uses different identity certificates to register and pay taxes, he or she must consolidate the taxes for archiving with the tax department before the application.

4 Calculation of Subsidy Amount

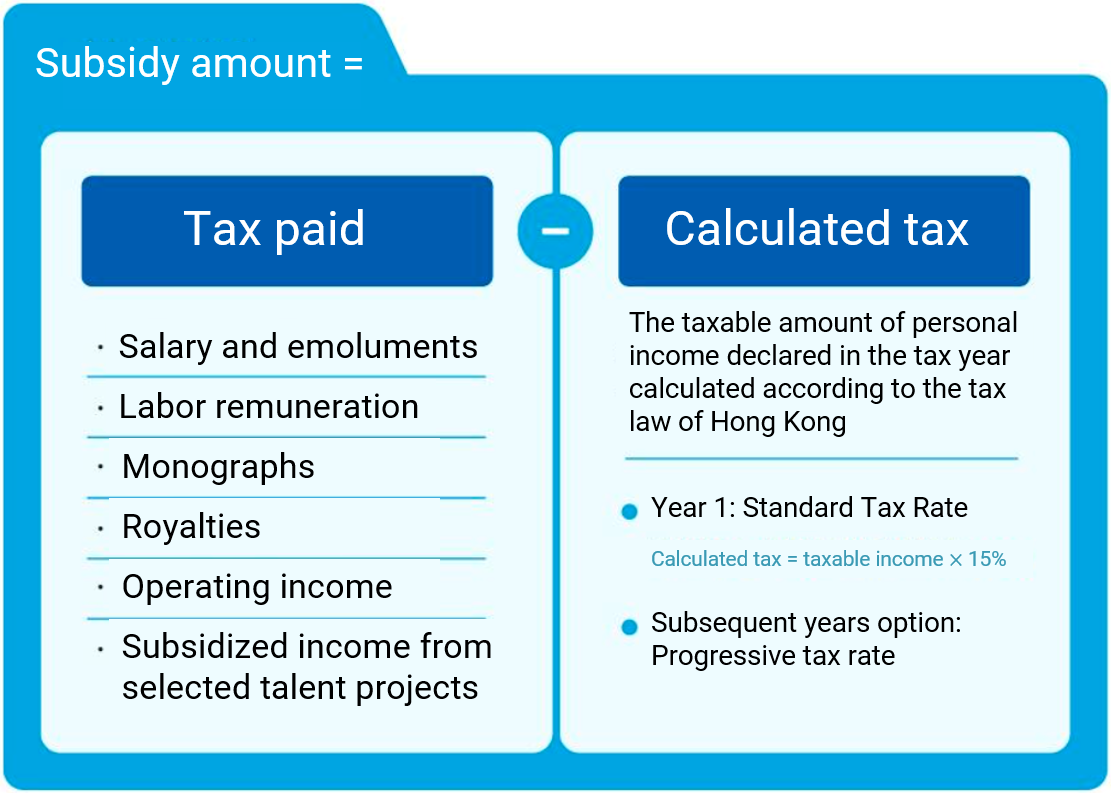

During the tax year, the amount of tax paid minus the estimated tax amount is the IIT subsidy amount for the current year that the applicant may apply for.

Calculation Method of IIT Subsidies

4.1 In the tax year of 2020, the amount of tax paid in Shenzhen by the applicant minus the estimated tax amount is the IIT subsidy amount that the applicant may apply for and the subsidy is exempt from individual income tax.

4.1.1. The "tax paid" refers to the IIT paid in Shenzhen in accordance with the "Individual Income Tax Law of the People's Republic of China" on the following income: (1) wages and salaries, (2) labor remuneration, (3) author's remuneration, (4) royalties, (5) business income and; (6) subsidies from talent program or project.

4.1.2 Where final settlement is applicable according to the tax law, the taxable amount of IIT should be based on the actual amount of tax paid for the whole year after the final settlement and tax refund in the following year. Where final settlement is not applicable according to the tax law, if there is no need for final settlement, the IIT amount paid should be based on the actual amount of tax paid in the whole year after the tax refund.

4.1.3 "Estimated tax amount" refers to the taxable IIT amount of the applicant in Shenzhen calculated according to the Hong Kong tax law. The estimated tax amount in 2020 is calculated according to the standard tax rate method, that is, the estimated tax amount = the taxable income of the applicant × 15%.

4.2 The IIT tax amount is calculated by item according to the individual income items and with combined subsidies (comprehensive calculation is conducted for comprehensive income).

4.3 If the applicant has applied for the 2020 incentive subsidies for high-level talents in Shenzhen and each district, such subsidies shall be deducted for the actual IIT subsidy amount. Where the IIT subsidy amount is lower than the total amount of the incentive subsidies high-level talents in Shenzhen and each district, no subsidy will be granted.

4.4 The maximum IIT subsidy amount is CNY 5 million.

5 Application Approval Procedure

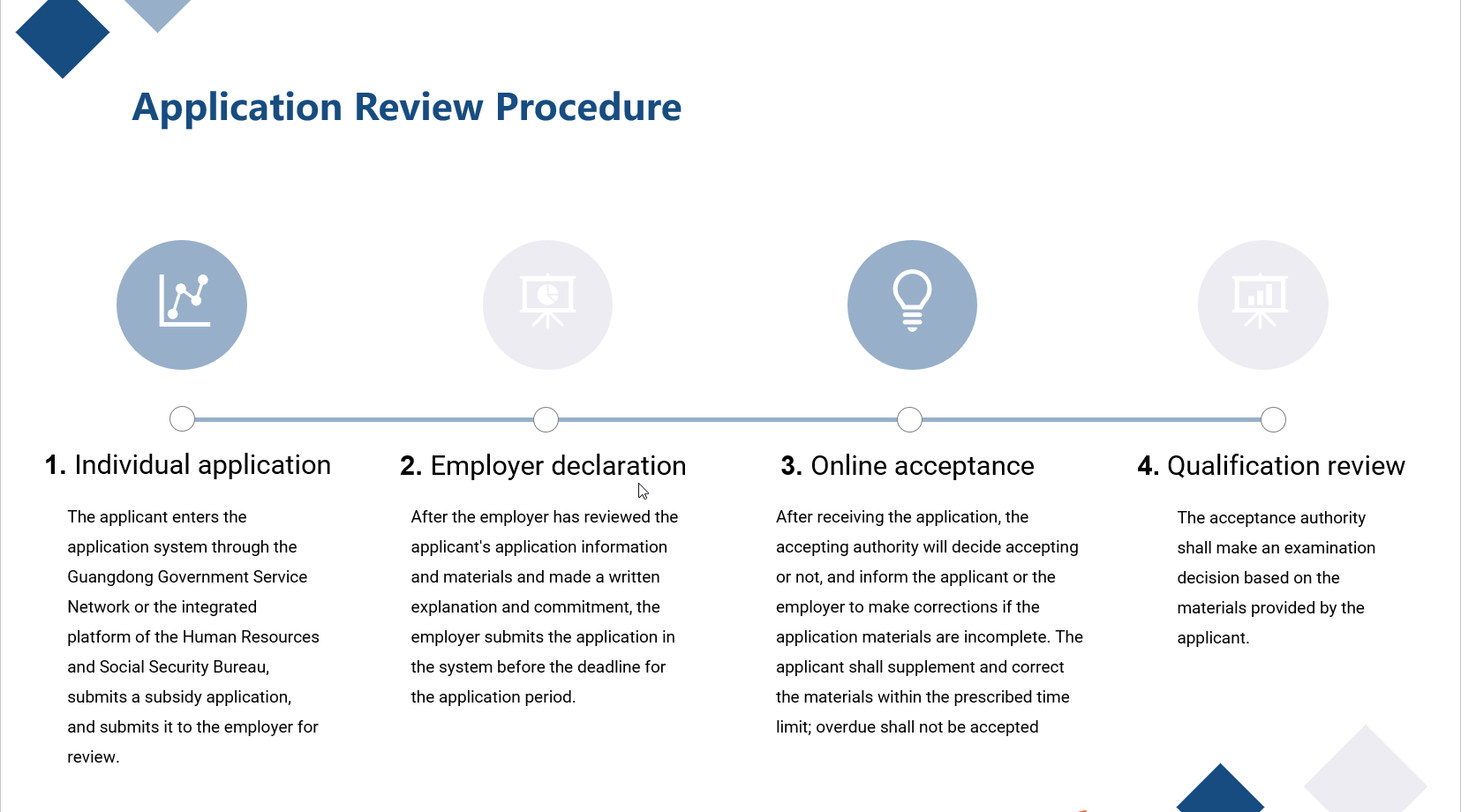

Step 1: An individual's application

From August 16 to September 30, 2021, an applicant shall file an application for a subsidy on the Guangdong provincial government service network, confirm the taxable income and the tax amount paid, submit all relevant materials, make a written commitment, and submit them to his or her employer for examination.

Step 2: An entity's declaration

After examining and making a written explanation or commitment for the declaration information and materials of an applicant, a declaring entity shall file an application on the declaration system by September 30, 2021.

Step 3: Online processing

The accepting authority shall decide to accept or not accept an application. If the application materials are incomplete, it shall notify the applicant or declaring entity to supplement or correct the materials. The applicant shall supplement or correct the materials within 30 days. If the materials are not supplemented or corrected within the time limit, the accepting authority will not accept the application nor notify the applicant or declaring entity. Those that meet the requirements for acceptance in cases of incomplete materials shall be governed by the relevant provisions on acceptance in cases of incomplete materials.

Step 4: Qualification examination

The accepting authority shall make an examination decision.

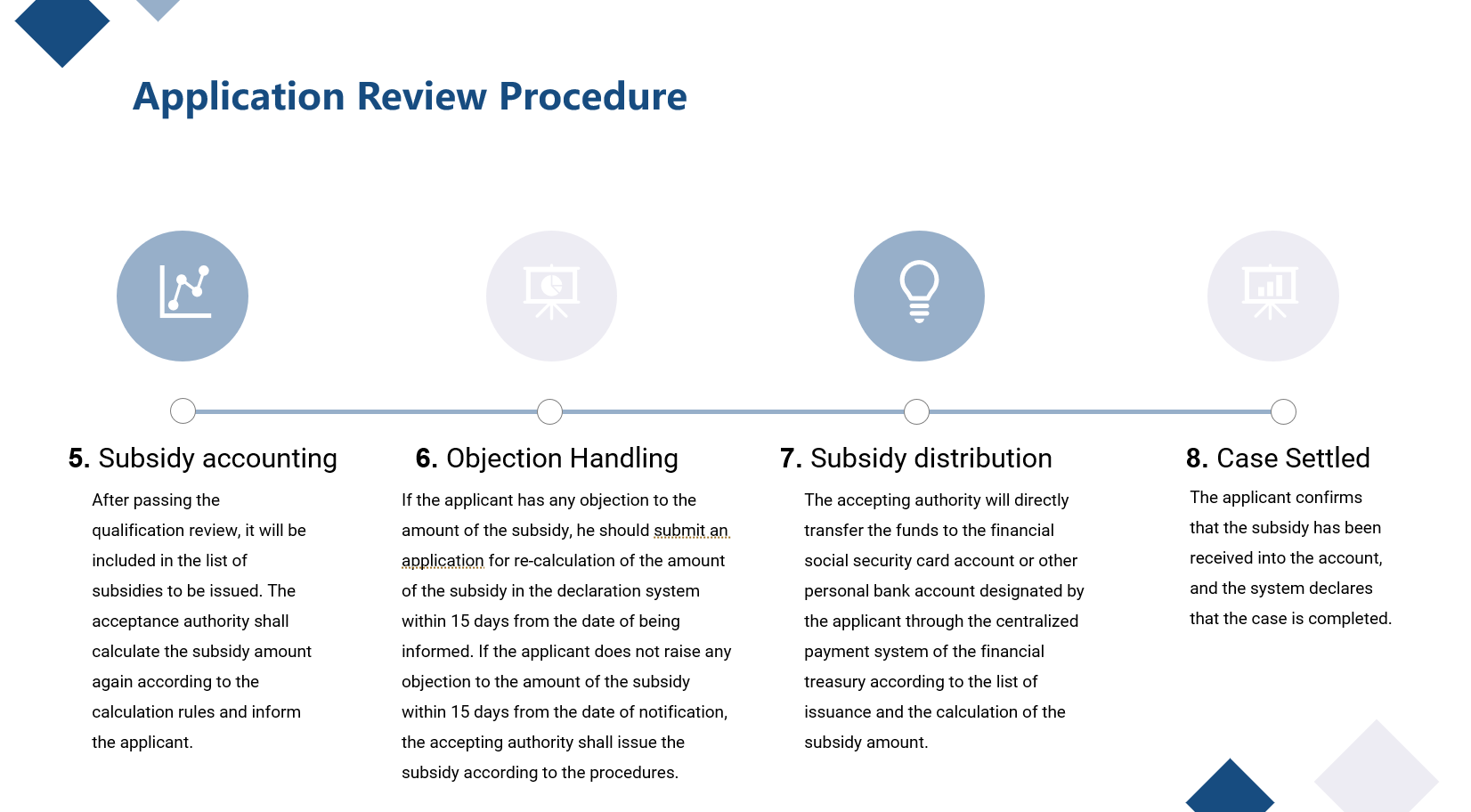

Step 5: Calculation of a subsidy

After the qualification examination is passed, the applicant will be included in the list of persons entitled to subsidies. The accepting authority will recalculate the subsidy according to the calculation rules and inform the applicant.

Step 6: Handling of objections

If an applicant objects to the amount of the subsidy, he or she shall apply for recalculation of the amount on the declaration system within 15 days of the date of notification. The accepting authority shall complete the calculation. If there is a difference after calculation, the amount shall be revised and the applicant shall be notified of the new amount. If an applicant does not raise any objection to the new amount of the subsidy within 15 days of the date of notification, the accepting authority shall issue the subsidy according to the relevant procedures.

Step 7: Issuance of a subsidy

The accepting authority shall check the issuance list and the calculated subsidy, and directly issue the funds to the financial social security card or any other personal bank account designated by the applicant through the centralized fiscal treasury payment system.

Step 8: Application Completion Procedure

The Applicant checks the subsidy and complete the application on the system.

6 Policy Reference

Scan the QR code to learn the policy.

This policy is valid until December 31, 2023.

FAQs:

1. What are the definitions of “Overseas High-end Talents” and “Talents in Short Supply in Shenzhen City”?

Overseas high-end and most-needed talents working in Shenzhen, specifically referring to those who work with an employer in Shenzhen and pay taxes in Shenzhen pursuant to law, and abide by laws and regulations, scientific research ethics and scientific research integrity. Meanwhile An applicant shall meet one of the following identity conditions:

(1) a permanent resident of Hong Kong or Macao, holding the permanent identity certificate of a Hong Kong or Macao resident or the Mainland Travel Permit for Hong Kong and Macao Residents.

(2) a mainland resident residing in Hong Kong or Macao (with his or her mainland registered residence cancelled), holding the identity certificate of a Hong Kong or Macao resident or the Mainland Travel Permit for Hong Kong and Macao Residents.

(3) a Hong Kong resident under the Hong Kong Quality Migrant Admission Scheme (for outstanding talents, professionals, or entrepreneurs), excluding dependents, and holding the identity certificate of a Hong Kong resident, the identity certificate of a mainland resident, and a relevant visa issued by the Hong Kong Immigration Department.

(4) a resident of the region of Taiwan, holding the Mainland Travel Permit for Taiwan Residents.

(5) a foreign national, holding a foreign passport or the permanent residence permit for foreigners.

(6) a returned overseas student who has obtained the right of long-term residence abroad, holding a Chinese passport, the identity certificate of a mainland resident, a long-term or permanent foreign resident certificate, and a foreign certificate of academic degree issued by the Chinese Service Center for Scholarly Exchange of the Ministry of Education. If necessary, a notarized certificate or certificate of recognition for the long-term or permanent right of residence issued by the Chinese embassy or consulate in the residing country or a notarized certificate and residence record issued by the embassy and consulate of the residing country in China shall be provided as supplementary documents.

(7) an overseas Chinese, holding a Chinese passport, the identity certificate of a mainland resident, a foreign residence certificate, and entry and exit records. If necessary, a notarized certificate or certificate of recognition for the right of residence issued by the Chinese embassy or consulate in the residing country or a notarized certificate and residence record issued by the embassy or consulate of the residing country in China shall be provided as supplementary documents.

2. Can the branch set up at other places by Shenzhen Headquarters enterprises apply for this policy?

The declaring entity must be a legally registered enterprise or institution in Shenzhen, which based on the information of the institution and registered by the market supervision, civil affairs and establishment management departments.

3.What are the specific contents about “Key industry or field for development”?

“Key industry or field for development" refers to enterprises and institutions that meet one of the conditions according to Article 6(13) at <Application Guideline>. The specific list of business organizations is based on the list provided and confirmed by the relevant industrial sector authorities.

4.How to calculate Individual Income Tax Subsidies?

In the 2020 tax year(during the period of 2020.1.1-2020.12.31),In the 2020 tax year, the tax amount paid by an applicant in Shenzhen City minus the estimated tax amount is the individual income tax subsidy that the applicant can apply for. The subsidy is exempt from individual income tax.

"Tax amount paid" refers to the amount of individual income tax paid in Shenzhen City in accordance with the Individual Income Tax Law of the People's Republic of China on the following income: (1) wages and salaries; (2) labor service remuneration; (3) author's remuneration; (4) royalties; (5) operating income; and (6) subsidy from admission to a talent project or program.

If final settlement is required under the tax law, the amount of individual income tax paid shall be subject to the actual tax paid for the whole year after the final settlement and tax refund are handled in the following year. If final settlement is not required under the tax law, the amount of individual income tax paid shall be subject to the actual tax paid for the whole year after the tax refund is made.

The estimated tax amount for 2020 is calculated according to the standard tax rate method: the estimated tax amount = taxable income of the declarer × 15%.

If an applicant has applied for the 2020 high-end talent awards or subsidies in Shenzhen City (or the various participating districts), the actual individual income tax subsidy shall be calculated after deduction of the total amount of high-level talent awards or subsidies in Shenzhen City (or the various participating districts); If the individual income tax subsidy is lower than the total amount of rewards or subsidies for high-end talents in Shenzhen City (or the various participating districts), no subsidy will be given. The maximum individual income tax subsidy is RMB 5 million.

5.What are the specific qualifications of “Middle-level & higher-level managers, scientific research team members, core technicians and workers and outstanding young talents of headquarters enterprises”?

“Middle-level & higher-level managers, scientific research team members, core technicians and workers and outstanding young talents of headquarters enterprises”are independently accredited by the applying entity, and the written description and commitment provided by the applying entity shall prevail.

6. What are the procedures of applying and issuing the subsidy?

The application procedures are: (1) An individual's application; (2)An entity's declaration; (3) Qualification examination; (4) Calculation of a subsidy; (5) Handling of objections; (6) Issuance of a subsidy.

The applications can be done online without submitting any paper materials to windows. After qualification examination and calculation of a subsidy, The accepting authority will directly issue the funds to the financial social security card or any other personal bank account designated by the applicant through the centralized fiscal treasury payment system.

7.What are the consequences if the individuals and entities make false declarations?

Handling the subsidies is subject to a credit and commitment system for declaration, in which applicants and declaring entities are responsible for the authenticity, accuracy, and completeness of the information reported. Regarding the written commitment made by an applicants or declaring entity, the accepting authority has the right to perform credit supervision and ex post audits, and the applicant or declaring entity shall cooperate in providing corresponding supporting materials. According to the Regulations on Talent Work of Shenzhen Special Economic Zone, if an applicant is found to have falsified any information during his or her application or at any other time, his or her application qualification shall be canceled, and he or she shall not re-declare the individual income tax subsidy within 5 years of the date of cancellation. If the individual income tax subsidy has been obtained, the subsidy issuing department shall recover the subsidy and charge interest on the subsidy. If a crime is suspected to have been committed, he or she shall be transferred to the judicial organ for handling in accordance with the law. If a declaring entity has falsified any information during the application or at any other time, it shall be handled with reference to the above mentioned methods.